The development of information and communication technologies (ICT) and ICT infrastructure are significant drivers of economic growth all over the world.1

7.1. Information technology solutions and app development

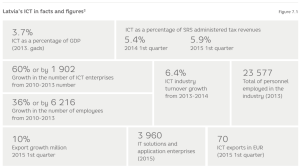

Estonia is the IT industry leader in the Baltic States. In collaboration with Silicon Valley, Estonian universities were able to attract venture capital funding in the amount of EUR 10–20 million per project (Latvia’s start–up enterprises typically attract EUR 1–2 million per project). In 2013, ICT made up 6.8% of Estonia’s GDP, whereas in Latvia the corresponding figure was only 3.7%. Estonia’s highest state officials are well-informed about developments within the ICT industry and during foreign visits they laud Estonia’s IT experience, helping Estonia’s IT sector to become globally renowned.

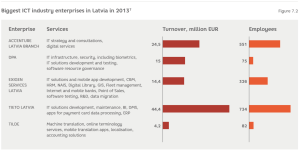

Latvia’s ICT market is limited. The biggest clients are the public sector, which requires specific solutions that cannot be replicated. 90% of the app business is comprised of programming services for international enterprises. There is a shortage of IT specialists capable of creating new products. Nevertheless, there are also successful start-up projects in Latvia, e.g. the smart address book Cobook5; infographics (infogr.am); the e-commerce platform for digital publishers (Fastr Books); and gaming platforms for online games (Amber Games).6

7.2. Challenges for the IT solutions and app development sector

The biggest challenges facing Latvia’s ICT sector are a lack of personnel and inadequate qualifications, funding for investments in research and development (R&D) and a low international profile in export markets.

By 2020, demand for IT specialists will exceed supply by 26%; overall, there will be a shortfall of about 100,000 programmers in the Baltic Sea region.8 Current education programmes do not provide the required quality and flexibility.

Finding IT specialists (programmers) is not the only problem; there is also a shortage of highly qualified support function specialists.9 The potential workforce possesses theoretical knowledge, but too little inter-disciplinary awareness and too few skills that are not directly related to their specialist profession. Graduates of this kind are suitable for writing code, but not for creating high value-added innovative solutions.

Azerbaijan and Kazakhstan are trying to diversify their economies and encourage innovation – financing sourced from their oil resources has enabled them to establish technology centres, attracting global ICT sector enterprises and highly qualified international IT experts. In order for Latvia’s ICT sector to continue to develop, it must be able to access sufficient human resources with the requisite qualifications. Ideally, international students would come to Latvia to study IT and remain after the completion of their studies and become part of Latvia’s ICT job market.

By making as effective and efficient use as possible of international funding availability for optimising IT education, an ICT School of Excellence should be established as the next step for students who have just received their Bachelor’s degrees. The ICT School of Excellence would provide study courses in modern ICT disciplines, linking these to the disciplines of business management and attracting international academic staff. The cost of such a world-class education programme would be in the region of EUR 1.5–2 million depending on the number of courses and lecturers (5-7 highly qualified ICT industry professors from the USA and teaching staff from Latvia’s universities and corporate sector). Collaboration with ICT industry enterprises would be necessary for the sustainable development of the project, offering them an R&D platform, as well as an external service in the form of training of current ICT enterprise employees in those ICT-related skills, mastery of which is the objective of the training currently being organised by these same enterprises for their own employees.

The creation of a human resources base is a precondition for the relocation of the world’s major ICT companies to Latvia, which would be an additional stimulus for economic growth. Share options are a widely used remuneration mechanism for promising new start-ups with limited capital. In this case, it would be vital to enact a tax policy that is conducive to awarding and utilising share options, as well as to establish a clear and simple legal mechanism for the emission and holding of shares in the event of the utilisation of options.

7.3. ICT infrastructure

Parallel to traditional infrastructure elements, i.e. railways, roads, ports and airports, as well as energy, in the 21st century, a decisive role in economic development will be played by all-encompassing telecommunications networks that ensure fast flowing data and information, thus increasing economic efficiency as a whole. Telecommunications infrastructure incorporates fixed and mobile networks and corresponding network elements.

Prior to 1998, each European country had a single fixed telecommunications operator that owned the networks. However, following the liberalisation of the telecommunications market in many European countries, there has been a rapid increase in the number of fixed service providers that have joined existing fixed network operators in making investments in infrastructure modernisation.10

In order to facilitate the development of a fixed network infrastructure in Europe, operators in the Netherlands, Portugal, Spain, Switzerland and several other countries not only made joint investments in the development of optical networks, but also jointly use them. The number of mobile operators in each EU country differs, but, on average, they tend to be 3-4 mobile network operators.

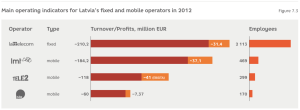

The turnover of the telecommunications sector in Latvia in 2013 was EUR 550 million. The fixed telecommunications market leader is Lattelecom which has an 80% market share. Lattelecom is also the main fibre optic cable provider, offering high-speed Internet of up to 500 Mb/s. The transition from analogue to digital television was completed in 2010, thus freeing up the 800 MHz frequency band range for mobile services.

In the mobile telecommunications field, there are three mobile operators: LMT, Tele2 and Bite Latvia. LMT and Tele2 each have a market share of approximately 37% of the total subscriber market. At the end of 2013, there were 2.558 million mobile subscribers in Latvia.

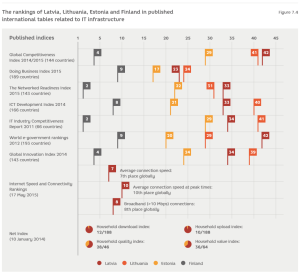

Investments to date in the development of telecommunications infrastructure have ensured its global competitiveness. According to data from the World Economic Forum, between 2014-2015, Latvia was ranked 35 (of 144 countries) in terms of the number of mobile telephone subscribers per 100 people, 28 in terms of the number of broadband internet subscribers per 100 people and 38 in terms of the speed (kb/s per user) of international internet data transmission.

However, the existing telecommunications infrastructure will not be sustainable, unless additional investments are made that cover the cost of research and development aimed at the innovation of new products and services and their promotion within the market. The relevant governmental bodies must take firmer action in dealing with those small telecommunications enterprises, which have established their infrastructure (mainly wire and cable networks) without the approval of the responsible institutions, thus forming a shadow economy.11

7.4. Main challenges facing the telecommunications sector in Europe and Latvia

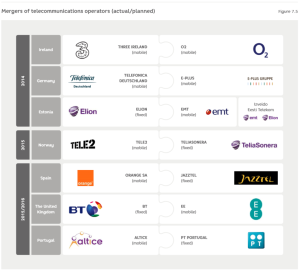

In order to retain market share, offering the aforementioned new services, as well as packages including TV, broadband Internet, fixed and mobile voice services, telecommunications operators have started converging in Europe and globally.12 In recent years, there have been several mergers involving mobile-mobile and fixed-mobile operator in Europe (Figure 7.5).

The European Commission has accepted the aforementioned merger processes, albeit often by setting additional terms and conditions. For example, in the case of a merger worth EUR 780 million EUR between 3Ireland and O2, the EC laid down the stipulation that the merged operator would be obliged to help to establish two new mobile operators in Ireland.13 In turn, in the EUR 8.6 billion merger between Telefonica Deutschland and E-Plus, the EC stipulated that Telefonica must agree to sell 20% of the capacity of the merged network to the virtual mobile network operator Drillisch.14

A certain challenge to the telecommunications sector is also posed by the agreement between the European Parliament, Council and Commission regarding the repeal of mobile communications roaming changes in the EU from June 2017. There is a possibility that the profits of mobile operators could be reduced as a result of the implementation of the agreement. Furthermore, users could dishonestly use the benefits provided by the regulation, e.g. by using mobile communications services in a country where they are cheaper, while continuing to reside in their country of residence. However, the agreement does make provision for the possibility of such instances, and mobile service providers are entitled to impose a small additional charge on “long-term roamers”.15

The aforementioned challenges and trends within the telecommunications industry both globally and in Europe are also applicable to Latvia’s fixed line and mobile operators. Large volume data transmission, involving vertical sectors, e.g. medicine, finance, M2M and OTT, requires high-speed broadband networks and mobile communications networks. In order for the concept of Europe’s common digital market to be implemented successfully, the performance of international online transactions requires networks capable of handling high-volume and high-seed data transmission.

One of the telecommunication sector’s current issues in Latvia that has received lengthy media coverage is the future development of the fixed-line service provider Lattelecom. Lattelecom could consider the possibility of buying one of the mobile communications operators. To implement such a takeover, Lattelecom would not require the consent of the European Commission, because the EC investigates mergers between companies, whose annual turnover exceeds EUR 250 million. In this case, the enterprises involved would need to receive the approval of the Latvian Competition Council, which could authorise such a merger if the enterprises involved operate in different markets.

Recommendations

Recommendation 1 – PROMOTING IT SKILLS AND EDUCATION

In order to ensure a workforce that is sufficiently large and well-qualified, interest in ICT must be encouraged from primary school onwards. International financing for optimising education must be utilised, establishing an ICT School of Excellence, offering study courses in the very latest ICT disciplines.

Recommendation 2 – SECURING ERDF FUNDING

ERDF funding should be utilised to support ICT applications to Horizon 2020 projects.

Recommendation 3 – LEGAL MECHANISMS FOR AWARDING STOCK OPTIONS

The Commercial Law should be amended to allow companies to issue and hold share/stock options. In addition, the tax burden should be eased, encouraging the award of options to employees of start-up enterprises, reducing the stock purchase rights holding period, which is currently 36 months to 12 or 18 months.

Recommendation 4 – MEASURES TO COMBAT THE SHADOW ECONOMY

There are many small and medium-sized telecommunications enterprises that have established networks without the approval of the corresponding bodies. In order to eradicate the shadow economy in the telecommunications sector, the Economic Crime Combating Authority should investigate all telecommunications enterprises and the infrastructure (primarily surface wires and cables) they have established. Moreover this monitoring must be implemented in collaboration with the leading telecommunications enterprises, which could train and advise the authority’s employees.

Recommendation 5 – ANALYSIS OF THE IMPACT OF MERGERS BETWEEN TELECOMMUNICATIONS OPERATORS

There have long been discussions in Latvia regarding potential mergers between telecommunications operators. The State must formulate its position on this matter. However, additional research is required analysis of all the “pros” and “cons”, particularly in relation to the impact of potential mergers on competition and consumer prices.

1 World Economic Forum, INSEAD. 2013. The Global Information Technology Report 2013. Geneva: World Economic Forum. Available at: http://www3.weforum.org/docs/WEF_GITR_Report_2013.pdf

2 Central Statistical Bureau (CSB). 2013. ICT sector statistics. CSB. Available at: http://data.csb.gov.lv/pxweb/en/zin/zin__datoriz__ICT_sektors/?tablelist=true&rxid=cdcb978c-22b0-416a-aacc-aa650d3e2ce0

3 Focus group. 2015. Riga. (Focus group including the following ICT associations and enterprises: Latvia’s information and Communications Association (LICTA), Latvian IT Cluster, Accenture Latvia Branch, DPA, Exigen Services Latvia, Lattelecom, Latvian State Radio and Television Centre (LSRTC), TechHub Riga and Tilde)

4 Estonian Association of Information Technology and Telecommunications (EAITT). 2013. Statistics Estonia. EAITT. Available at: http://www.itl.ee/eng

5 http://www.fold.lv/en/2014/02/springboard-for-technology/

6 LIAA. 2013. Information and Communication Technology Industry in Latvia. LIAA. Page 5.

7 LIAA. 2013. Information and Communication Technology Industry in Latvia. LIAA. Pages 12-37.

8 Ministry of Economics (MoE). 2014. Information report on the mid- to long-term prospects of the job market. MoE.

Available at: https://www.em.gov.lv/files/tautsaimniecibas_attistiba/EMZino_150814.pdf

9 Focus group. 2015. Riga

10 Grijpink F. et al. 2012. A New Deal: Driving investment in Europe’s telecoms infrastructure.

McKinsey & Company, 33 pages.

11 Focus group. 2015. Riga

12 Standard and Poor’s Rating Services. 2015. European Telecoms Operators Jockey for Position As M&A Surges Forward. Page 3.

13 Weckler A. 2015. 3 Ireland finally completes acquisition of O2 for €780m. Available at: http://www.independent.ie/business/3-ireland-finally-completes-acquisition-of-o2-for-780m-30433999.html

14 Filtz M. 2014. Telefonica Deutschland closes €8.6 bn acquisition of E-Plus. Available at: http://www.zdnet.com/article/telefonica-deutschland-closes-eur8-6bn-acquisition-of-e-plus/

15 European Commission. 2015. Roaming charges and open internet. Available at: http://europa.eu/rapid/press-release_MEMO-15-5275_en.htm