Forests are one of Latvia’s few strategic resources. In terms of forest coverage, Latvia is one of the six richest countries in the EU, because forests cover 50% of the country’s territory. Moreover, Latvia’s climate and soil are suitable for ensuring a competitive combination of fast growth and high quality timber. In 2013 the volume of growing stock in Latvia’s forests amounted to 667 million m3, while annual growth exceeds 25 million m3. Annual felling volumes amount to approximately 63% of the growth in stock (by way of comparison: in Finland the corresponding figure is 70%, while in Sweden it is 85%) and provide for logging at a level of 11 -12 million m3 annually. Crucially, 49% of forests in Latvia belong to the State, which, through planned management, stabilises the flow of timber processing raw materials.

Forest resources are closely related to Latvian identity and are critical for the economic development of rural areas. The forest sector is comprised of forestry1 and the timber industry2. It generates almost one third of GDP value added by Latvia’s primary and secondary sectors, while it is a source of income for 9% of the country’s labour force. The timber industry is the most economically significant part of the two, contributing 70% of the sector’s added value, and employing 65% of its total labour force.

One of the central economic effects of the timber industry is its status as a cornerstone of the Latvia’s balance of trade. In 2014, exports exceeded imports by EUR 1.43 billion.

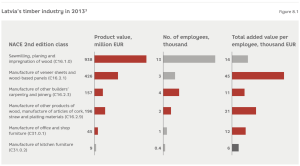

Secondary processing comprised 54% of the added value of Latvia’s timber industry and 63% of the total added value, and was responsible for 58% of the total number of employees in the industry. The most notable contribution made by secondary processing came from the veneer sheet and wood panel manufacturing sub-sector, which alone makes up 28% of added value from timber processing and which has the highest ratio of added value to product value. Also noteworthy is the manufacture of other builders’ carpentry and joinery, in which the number of workers is rising, as is added value per employee.

8.1. The timber industry’s main challenges and possible solutions

Comparisons with Finland and Sweden, which have even more forest cover than Latvia, and in which the timber industry has long developed under market economy conditions, are useful for determining the sector’s problems and future tasks. Added value per employee generated by the timber industry in Nordic countries is up to ten times higher than that generated in the Baltic states (Figure 8.2). For example, 11,800 workers employed in the primary processing of timber in Sweden manufacture products worth EUR 5.1 billion. In contrast, 12,500 workers employed in the corresponding sector in Latvia manufacture products worth just EUR 875 million. Much has already been achieved, but the results of interviews with company managers in Latvia point to the potential of automated manufacturing in raising productivity.

More efficient use of timber resources to generate added value in Latvia

Latvia’s timber sector has a high proportion of products that can be subjected to more extensive secondary processing, thus creating a greater amount of added value. In 2014, logs and sawn timber comprised 37% of the value of exported products. Subjecting these raw materials to secondary processing in Latvia it was possible to generate an additional EUR 0.28 of added value per unit of products sold.

In 2014, Latvia’s timber industry exported approximately 1.9 million m3 of softwood pulp. If this pulp were to be secondary processed in Latvia, manufacturing panels similar to Kronospan, then the value added by the industry would grow by approximately EUR 72 million, creating about 400 new jobs and raising productivity within the timber industry by 14%. In order for this economic effect to be achieved in a comparatively short space of time, the Latvian Development Agency, with the support of other State institutions, should attract investors in the form of global or regional secondary processing enterprises with major established sales markets.

From the perspective of timber industry investors, Latvia’s advantage is the availability of timber materials suitable for secondary processing and lower labour costs. In contrast, Scandinavian lose added value because of high personnel costs.

Increasing consumption of the timber industry’s products in Latvia

The sub-sectors of Latvia’s timber industry would benefit from an increase in the value of local timber and wood product market.

For example, one example of low timber consumption is the low demand for wooden houses in Latvia. In comparison, in Finland wooden houses are very popular. As a result, Finnish manufacturers sell 82% of their products on the local market. Latvia’s wooden house manufacturers, mostly comprised of small and medium-sized enterprises, have a limited domestic market and immediately encounter the challenge of selling these quite complicated products in foreign markets.

There little likelihood of an immediate increase in the use of timber and wood products in construction, because this is restricted by shortcomings in Latvia’s construction standards required for the utilisation of EU regulations. Architects argue that the fire safety requirements in Latvia’s construction standards restrict the use of wood, despite the fact that in several countries, including Norway for example, multi-storey wooden buildings are built meeting all safety requirements. Latvia’s construction standards were adopted in 2015. The Ministry of Economics plans to gradually review them. Faster and more appropriate passage of amendments to construction standards is important for the development of the timber industry.

Despite these circumstances, construction projects, such as the Amatciems estate, have been completed in Latvia in which wood is not only an important, but occasionally even the main building material. With public support, public sector organisations and timber manufacturers have collaborated on a notable civil engineering pilot project – a wooden footbridge over a carriageway. Such pilot projects are vital in demonstrating the extensive possibilities offered by the use of wood, as well as its durability, economic viability, safety and environmental aspects. The potential use of public commissions in the development of such pilot projects is significant – public requirements could be met by designing and building wooden structures, thus creating positive examples.

Capital accumulation in Latvia’s timber industry

In the face of rising labour costs, Latvia’s timber manufacturers can retain and improve their competitiveness by increasing their productivity and modernising production plants. Productivity in the Finnish and Swedish timber industries is 3-7 times higher than in Latvia. This is the level that Latvia should also aspire to. However, it is important to note that, in terms of the value of their manufactured products, enterprises in the Nordic countries are bigger than in Latvia. In the case of primary processing, they are 3-4 times bigger. Thus, in order to achieve a similar level of productivity, many of Latvia’s timber industry enterprises would have to increase their operating volumes several times over, which requires capital investment in the development of manufacturing, investments in fixed assets, as well as business skills and competence in regard to working on a bigger scale.

In 2013, the value of fixed assets on the balance sheets of Latvia’s timber processing companies was similar to the corresponding level in 2008. However, in furniture manufacturing, the value of fixed assets had fallen by 34%. Although the industry’s most powerful players such as Latvijas Finieris implement considerable investment programmes, the overall speed of capital accumulation within the industry is still slow. The dynamics of the volume of investments offer no indication of rapid growth within the industry.

An analysis was conducted of individual enterprises within the timber industry. This revealed that although economically powerful and upwardly mobile timber industry enterprises can attract the external financial resources they require, credit institutions are reluctant to lend funds for term of over three years without a planned review of the terms involved. For some timber industry enterprises, their chosen operating model and internal factors produce poor results, thus rendering them unattractive candidates for the investment of private or public financial resources. The slow pace of capital accumulation is due to various restrictions on development: manufacturers whose size makes them non-competitive in regard to particular types of product, the time required to secure a share of the market commensurate with available capacity, difficulties in driving sales in a sector characterised by intensive marketing, as well as the limited availability of funding.

The challenge of capital accumulation is considered more extensively in Chapter Four, which focuses on the availability of funding.

Recommendations

Recommendation 1 – More efficient use of timber resources to generate added value in Latvia

In order to attract strategic investors to a large-scale production plant formation project in the potentially lucrative secondary processing field, e.g. in the panel manufacturing sub-sector a competitive strategic investment project offer must be drawn up and potential investors must be sought proactively, including with the support of senior government officials and members of the diplomatic corps.This is a task for the Latvian Development Agency. the Ministry of Economics and the Ministry of Foreign Affairs

Recommendation 2 – Increased consumption of timber industry products in Latvia

The contents of Latvia’s construction standards should be reviewed and revised, augmenting and improving their requirements in order to bring them into line with the latest innovations and technological developments in the use of wood carpentry and joinery products in the EU, in order to eradicate obstacles to the wider use of wood materials in Latvia’s construction sector (a task for the Ministry of Economics). Under the auspices of state and municipal orders, pilot wood construction projects should be implemented (in form of buildings and engineering structures), which demonstrate the possibilities and effectiveness of the use of wood in Latvia.

Recommendation 3 – Capital accumulation within Latvia’s timber industry

Continuous provision of public support to help companies break into overseas markets. Support should be provided for participation in trade fairs, trade missions and assessment of the compatibility of production plants and their products (a task for the Ministry of Economics and Ministry of Finance). Political support should also be actively provided for the formation of external economic relations during presidential visits overseas. Public support should also be provided to increase the availability of international level management consultation services to support the capacity of senior management within the timber.

1 NACE 2nd edition. A02 (forestry and logging).

2 NACE 2nd edition. C16 (Manufacture of wood and products of wood and cork, except furniture; manufacture of straw and plaiting materials) and C31 (manufacture of furniture).

3 LR CSB. Indicator dynamics trends 2008-2013: – growing; – declining; – non-discernible; no data about the manufacture of parquet panels or the manufacture of wooden containers

4 Eurostat. Added value factor costs per employee, thousand EUR